geothermal tax credit canada

Check with your local installer and tax professional for more details. And if it exceeds 86 you will receive.

United States Geography For Kids Tennessee

In a release shared today it was announced that Kitselas Geothermal Inc a majority owned Indigenous company between Kitselas Development and Borealis Geothermal have entered a Joint Development Agreement JDA with Shell Canada Energy taking effect on July 29 2022.

. Moreover there is a 15 percent tax credit on the remainder of the capital costs of the geothermal system excluding the heat pump. 100000 10000 2 95000. Free for Geothermal Canada members see member email for promocode.

The JDA supports de-risking and appraisal of the geothermal resource in. Free for Geothermal Canada members see member email for promocode. 5 hours agoThe Act extends the investment tax credit ITC for solar geothermal biogas fuel cells waste energy recovery combined heat and power small wind property and microturbine and microgrid.

2373 CRCE treatment will be available for expenses in geothermal projects. A 75 tax credit on geothermal heat pumps that are manufactured in Manitoba for use in Manitoba plus a 15 tax credit on the remainder of the capital costs of the geothermal system excluding the heat pump if the installer is certified by the Manitoba Geothermal Energy Alliance Inc. For example Enbridge Gas Distribution offers homeowners up to 2000 to cover the cost of a home.

Ontario Rebates and Incentives. 1000 10000 x 10 yearly provincial credit from the British Columbia Home Renovation Tax Credit For Seniors and Persons With Disabilities. Federal Rebates 5000 Canada Greener Homes Grant Program.

Adjusted cost means an amount equal to 125 of the manufacturers cost of manufacturing the heat pump. This includes installations into most buildings including existing and newly constructed residential and commercial buildings. 48 of the tax code under Sec.

Up to 500 dollars rebate is available. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity.

The tax credit equals 26 of the eligible system costs including the heat pump ground loop field etc. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. The rules and Directive 089 are effective August 15 2022 and set out the requirements that industry must follow throughout the entire life cycle of a geothermal development from initiation through to closure when developing geothermal resources below the base of groundwater protection.

Federal Budget 2021 proposed a number of measures to facilitate Canadas economic recovery and to promote the manufacture and use of clean energy equipment. As part of the three-year program rebates are available to existing and new homeowners who improve their energy efficiency with Geothermal Units. For tax years starting before July 1 2023 manufacturers can also claim an 8 tax credit on the.

The rules and Directive 089 introduce requirements and. Property is usually considered to be placed in service when installation is complete and equipment is ready for use. The tax credit is available for new construction or existing homes owned by the tax payer.

A Manitoba Green Energy Equipment Tax Credit up to 15 is available for the installation of eligible geothermal systems throughout Manitoba. Manufacturers can claim a 75 tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association. Access to all 16 lectures is included with a Geothermal Canada membership 40year.

If the installer is certified by the Manitoba Geothermal Energy Alliance Inc there is a 75 percent tax credit on the geothermal heat pump manufactured in Manitoba for use in Manitoba. The LLC owners are in a 40 marginal tax bracket when state income tax is included 2020 Tax Credit. Atlantic investment tax credit of 10 of the cost of prescribed energy generation and conservation.

On May 27th 2021 the Federal Government of Canada officially launched the Canada Greener Homes Grants programThis rebate program will pay Canadians up to 5000 for home renovations and upgrades that increase energy efficiency. In Ontario several different groups including Enbridge Gas Distribution Hydro One Independent Electricity System Operator Ontario Electricity Support Program and Toronto Hydro offer rebates and incentives. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings.

Due to the 2022 federal budget the HATC claim amount has increased from 10000 to 20000 which means you can now get a tax credit up to 3000 instead of 1500. The province is investing 36 million in consumer rebates to help Albertans reduce their greenhouse gas emissions.

Heat Pump Rebates In Various Canadian Provinces

Minnesota Map Moved Minnesota Minnesota State Moorhead Minnesota

Incentives Manitoba Geothermal Energy Alliance Mgea

Heat Pump Rebates In Various Canadian Provinces

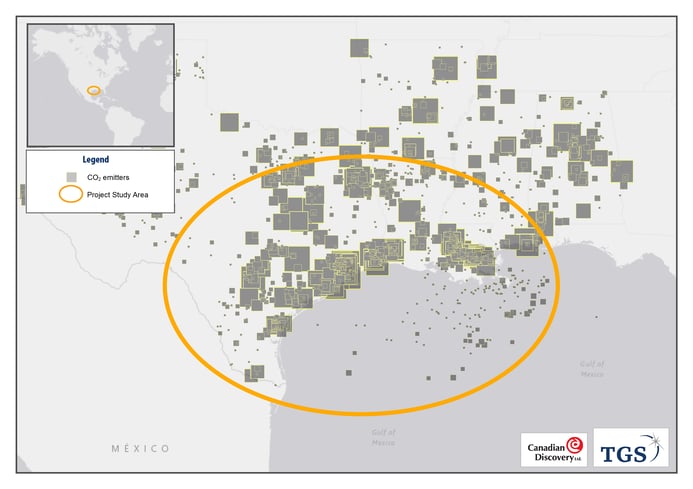

Tgs Announces The Southern U S Co2 Storage Atlas

Heat Pump Rebates In Various Canadian Provinces

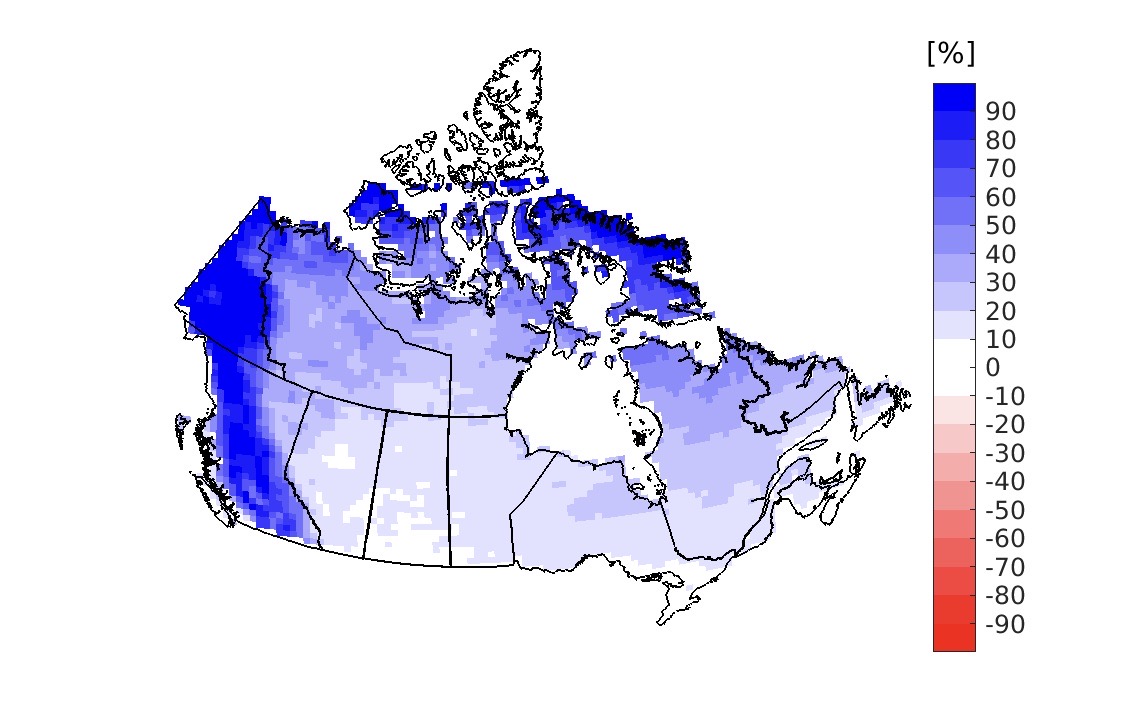

Climate Resilient Buildings And Core Public Infrastructure An Assessment Of The Impact Of Climate Change On Climatic Design Data In Canada

Canada Us Survey Finds Us States More Attractive For Oil Investment

Canada S 170 Ton Carbon Price Makes Heat Pumps Financial Winners Cleantechnica

Rebates And Incentives For Wind Power In Canada

Going Green Tax Credits Rebates And Government Programs Loans Canada

Recorrido Del Rio Hudson City Island Lake Ontario Lake Huron

Heat Pump Rebates Available Options Maritime Geothermal

August 4 2021 If You Re Debating Adding Solar Panels To Your Business Or Home You Ve Probably Heard Solar Energy For Home Solar Power House Residential Solar

Canada Gasoline Consumption Data Chart Theglobaleconomy Com

Canada Employment In Agriculture Data Chart Theglobaleconomy Com

Renewable Energy Country Attractiveness Index Us Dropped From 1st To 3rd The Full Pdf Is Avail Vi Renewable Energy Solar Energy Projects Solar Energy Facts

Progress Continues For Deep S Canadian Geothermal Project Geodrillinginternational